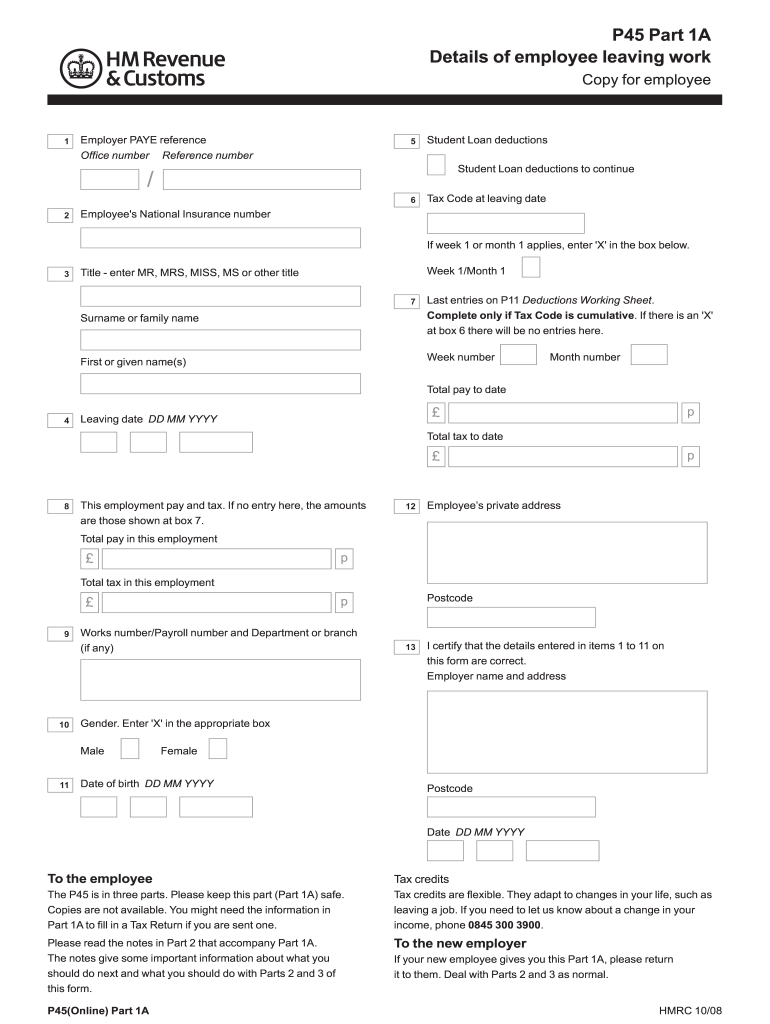

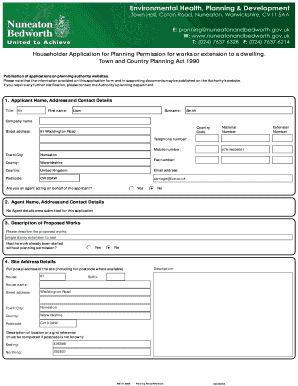

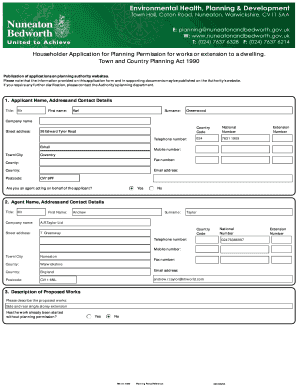

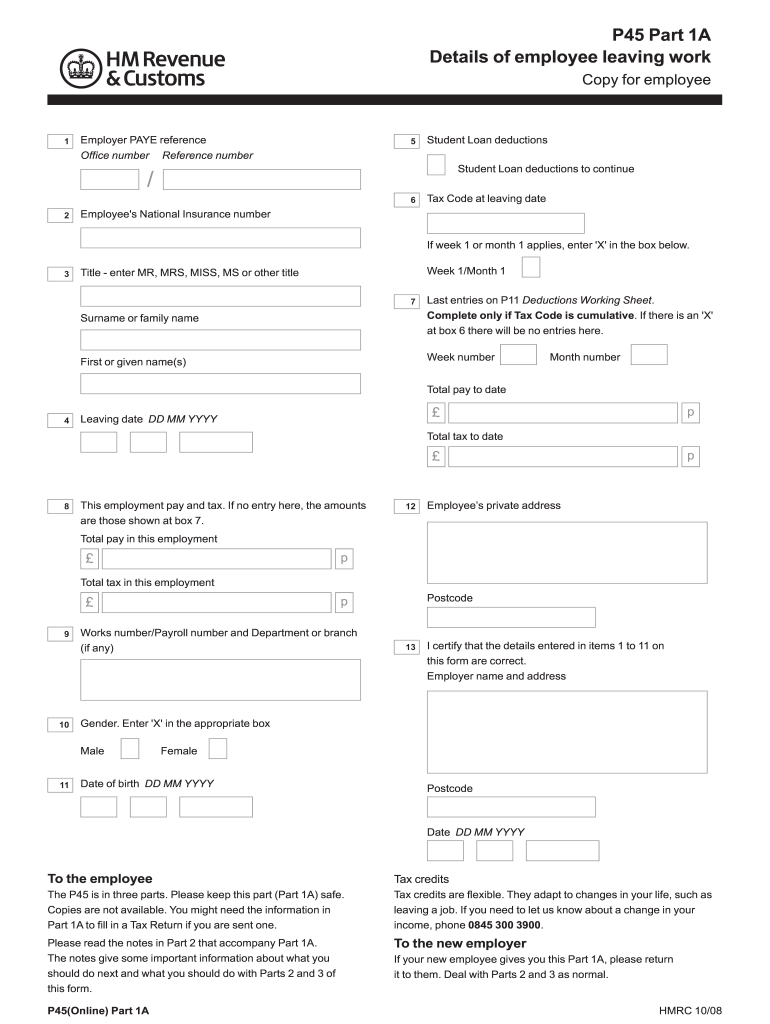

UK P45(Online) Part 1A 2008-2025 free printable template

Get, Create, Make and Sign blank p45 form

How to edit pay tax online

How to fill out blank p45 forms

How to fill out UK P45(Online) Part 1A

Who needs UK P45(Online) Part 1A?

Video instructions and help with filling out and completing p45 form printable

Instructions and Help about p 45 part leaving work form

Music hello this is Julius from basic financials this video is going to be about your For p45 now unfortunately sometimes this means you might have lost your job you might have left your job I'm gonna code, or you might have lost it because you've been sacked oh no and either way you get a p45 when you leave somebody's employment so p45 and its multi-part forms as a full platform and the first part is for you to keep and the other three parts are for you to pass to a new employer once you have started another job now we'll come back to that, but that's very important so don't just file it away somewhere and do a file it away you'll pick up part one because that tells you the information you might need for your tax return if for example you don't get another job before the end of the tax year and when you get a p45 from an employer they won't give you a p60 at the end of the year the p60 if you have seen any of my other videos p60 is what you get from your employer at the end of the tax year to show you a summary of your income gross pay your tax deducted and also shows the National Insurance Contributions to there but if you've not if you're not with that employer lender here even though they've paid you for that year they won't give you a p60 because all they're going to give you is that p45 that p45 will show on it the employer reference the employer address your reference in your address it will show the data of leaving, and it will show your gross pay up to that point of leaving and your tax deducted up to that point of leaving now this P 45 could be very important say for example you leave halfway through the, and you don't get another job for six months and that coincides say you leave in roundabout September and you haven't got another job by the fifth of April now you will have only received six months worth of your allowances because some the tax system works on a cumulative basis your personal allowance which at the moment is twelve and a half thousand pounds you would only have received half of that so six thousand two hundred and fifty pounds now that means if you haven't had any other income during the year, and you would be entitled to another six thousand two hundred and fifty personal allowance rest of your allowance for the whole year, so you would be entitled to a refund, and you would use that p45 to send to the tax office there's evidence of what your income is the tax being has been deducted and that would get you a refund, so that's one reason to keep hold of your p45 and now the other reason is as I said before when if you do start a new employment you should give part two three and four to your new employer and that will allow them to plug those figures of gross pay the date and the in tax deducted to date into their payroll system and that that will ensure that the paint will continue to work on a cumulative basis so that what their system will look at what your gross pay from their employment plus your previous...

People Also Ask about p 45 part 1 leaving work form

How long does an employer have to issue a P45 UK?

What is a P45 form in the UK?

How long do I need to keep payroll records UK?

How do I get my P45 Ireland?

What happens if I haven't received my P45 UK?

What is a P45 form in Jamaica?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit p45online a leaving work form from Google Drive?

How can I get p45 part 1 a work form search?

How can I edit p 45 1a leaving work form latest on a smartphone?

What is UK P45(Online) Part 1A?

Who is required to file UK P45(Online) Part 1A?

How to fill out UK P45(Online) Part 1A?

What is the purpose of UK P45(Online) Part 1A?

What information must be reported on UK P45(Online) Part 1A?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.